Request yourloan in a simple way

I agree

Request your loanin a simple way

I agree

We help you get the best mortgage so that you can enjoy your new home as soon as possible.

About Us

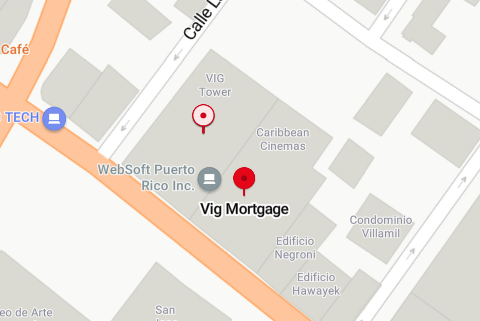

We are a Mortgage Bank with the OCIF IH148 license and NMLS Federal Registry ID: 214767. Experts and specialists only in mortgage loans. We have been in PR for about 15 years, where thousands of satisfied customers endorse and recommend us. Our team aims to your satisfaction based on realities.

We are directly backed by HUD, FHA, Veterans Department, USDA Rural, etc. Each ViG Mortgage executive is licensed by OCIF (Office of the Commissioner of Financial Institutions) at the PR level and registered in the vast majority of U.S. states. We are committed to our customers looking to have more mortgage products than any bank in PR, to have your safe option. We work to find APPROVAL as quickly as possible. Home loans can be complicated; we'll make it simple for you.

Mission

- Have the required products that adapt to the profile of each mortgage transaction.

- Our greatest asset is the work team.

- The truth is always expected, even when this is not the expected or desired result.

- We are passionate about being better than yesterday every day. See more...

- Making mistakes are not what we are looking for, but we will make them along the way. This indicates that we seek perfection and are responsible for them as a group.

- We compete with ourselves, we create our way of doing things, and as a team, we support them, even if they seem contradictory to what is stipulated in the industry.

- We continually evolve, using all the existing technological resources to give a unique experience.

- We do not accept breaches of the rules and laws that frame our industry, and there is no material good that leads us to commit a crime consciously.

- In our hands, we have the trust placed by people and families who seek to own the place where they will have their home.

- Our commitment and responsibility are values that go above all else.

|

|

Vision

See more...

The continuous education of all, concerning the approval guides of each product and new emerging technologies is essential to our job and is part of our culture.

We aim to provide a unique service to all parties involved in a mortgage transaction, be it a prospect, client, real estate broker, seller, business partner, service provider, etc.

Internal communication is as good as or better than external communication. In this way, we achieve better results. We are not perfect, but this is not why we are afraid to make decisions that can streamline our procedures. We consult and work as a team and learn from our failures; pride is not part of our culture.

Our culture and work formula leads us to be homogeneous in each of the transactions we work on, taking into account: (Time, communication, knowledge, discernment, and compliance.)

The best mortgage bank is the fastest. Every day we take care of aspiring to be.

Joy, happiness, familiarity, objectivity, fairness, and honesty are part of our values consistent with our culture.

We are a technological organization in a Mortgage Bank that seeks advances and continuous improvements that facilitate the flow of work and communication and the demands of a consumer of this time.

TESTIMONIALS FROM

Our Products

Our Products

Program of the Federal Department of Agriculture (For Purchase) of the principal residence.

For people of low to moderate income and verifiable with pay stub, taxes and W-2.

Must be eligible by Max Family Income:(1-4 members) $103,500 of (5-8 members) $136,000.

- Up to 101% LTV (borrowing margin).

- Annual mortgage insurance .35%

- Mortgage Insurance Once financed, 1%

- It can be loaned to include closing costs under certain conditions.

- You can buy a single-unit primary residence or refinance to lower RURAL loan payments.

- It allows lending to buy and make repairs up to 10% or $10,000, provided that the property values that difference above the sale price (RURAL repairs).

- Area condos may be RURAL (call and verify), not FHA listing.

The property must be within an area called RURAL in PR, according to the map:

- Loan for principal residence, second and investment.

- Up to 80% LTV without mortgage insurance.

- 95% with private mortgage insurance for the main residence. (The mortgage insurance premium can be financed by up to 2%.)

- You can finance up to 90% LTV for the second residence with private mortgage insurance.

- For investment, you can reach up to 80% LTV without mortgage insurance.

- Qualification by a verifiable pay stub, income tax return, and W-2.

- Competitive interest rates.

- Limit $647,200.00 for one unit, $858,700.00 for two units, $1,001,650.00 for three units and $1,244,850.00 for four units.

Purchase

In summary, buying a home is a great dream that can be achieved with financial planning and hand in hand with one of our experts. It is a valuable investment and a great source of happiness and satisfaction for you and your family. At VIG Mortgage we have the products and the experts to achieve that great dream.

Refinancing

Refinancing is a term that refers to paying off the current mortgage through another mortgage loan in which closing costs are included and you can have a surplus for different purposes. The approval of a surplus will be determined by the repayment capacity of the applicant in addition to the result of the appraisal. The action of borrowing on a property that you do not owe is also known as refinancing.

If the property's value has increased since it was purchased, refinancing may allow the homeowner to obtain a mortgage for an amount greater than the original loan balance. Additional funds can be used to make improvements to the property, such as renovating a kitchen or bathroom, adding a room, installing new windows, among others. In addition, refinancing can also allow the homeowner to pay off debts, such as credit cards or personal loans, which may have a higher interest rate than the mortgage. Another of the advantages that you can receive from a refinance is to reduce the term of years of your current mortgage..